Panamanian Corporations (S.A.): Strategic benefits, structure, and tax optimization

The Panamanian Corporation (Sociedad Anónima, S.A.) is a cornerstone of global investment, renowned for its legal robustness, operational flexibility, and unique fiscal advantages. Governed by Law 32 of 1927 —strengthened by reforms such as Law 254 of 2023 (economic substance) and Law 129 of 2020 (transparency)—, this structure is favored by multinational corporations, investment funds, and entrepreneurs. Below is an in-depth analysis of its benefits, requirements, and strategies to maximize its potential.

1. Exclusive Benefits of Panamanian Corporations

A. Unparalleled Fiscal Advantages

Territorial Tax System:

Zero Taxes on Foreign Income: S.A.s only pay taxes on economic activities conducted within Panama. Income generated abroad (dividends, royalties, interest, services) is 100% exempt from income tax.

Practical Example: A Panamanian S.A. managing properties in Europe or licensing software to Asia pays no taxes in Panama on those earnings.

VAT and Withholding Exemptions:

International transactions (e.g., goods sales, digital services) are exempt from VAT.

No withholding tax on payments to non-residents, ideal for structuring royalty streams or dividends.

Double Taxation Treaties (DTTs):

Panama has DTTs with 24 countries, including Mexico, Spain, Portugal, Singapore, and the UAE. These agreements prevent double taxation and reduce withholding rates.

Use Case: A Panamanian S.A. operating in Mexico can apply a reduced 10% tax rate (vs. 25%) on dividends under the DTT.

B. Confidentiality and Asset Protection

Anonymity of Shareholders and Beneficiaries:

Shareholder names are not listed in public records. Only the registered agent and board of directors have access to this information, protected under Article 39 of Law 32.

Immunity from Foreign Lawsuits:

Panamanian courts do not recognize foreign judgments against local S.A.s, except under specific treaties. This shields assets from seizures or international litigation.

C. Operational Flexibility and Low Costs

Adaptable Share Capital:

No Legal Minimum: Authorized capital can start at USD 1, though USD 10,000 is recommended for commercial credibility.

Shares Without Par Value: Facilitate capital redistribution without specifying face value.

Remote Management:

No physical meetings required for shareholders or directors. Decisions can be made via email or digital platforms.

International Directors/Shareholders: No nationality or residency restrictions.

Competitive Maintenance Costs:

Annual Tax: USD 300, regardless of capital or revenue.

Registered Agent Fees: Approximately USD 500-1,000/year, including document custody services.

2. Incorporation Process: Details and Best Practices

A. Name Reservation and Documentation

Naming Rules:

Avoid terms like "Bank," "Trust," or "Insurance" without prior authorization.

Names can be in any language but require a Spanish translation for registration.

Corporate Bylaws:

Broad Corporate Purpose: Use generic clauses (e.g., "engage in any lawful activity") to avoid future amendments.

Anti-Dilution Clauses: Protect majority shareholders during new share issuances.

B. Post-Registration Requirements

Corporate Books:

Board Minutes: Appoint at least 3 directors (entities permitted).

Share Register: Detail share issuances, transfers, and holders. Books can be maintained offshore.

Economic Substance (Law 254):

"Relevant" Activities: S.A.s engaged in finance, leasing, distribution, or intellectual property must:

Maintain a physical office in Panama.

Hire local employees (at least 2 full-time).

Incur operating expenses proportional to income.

Non-Compliance Penalties: Fines of USD 5,000-100,000 and potential dissolution.

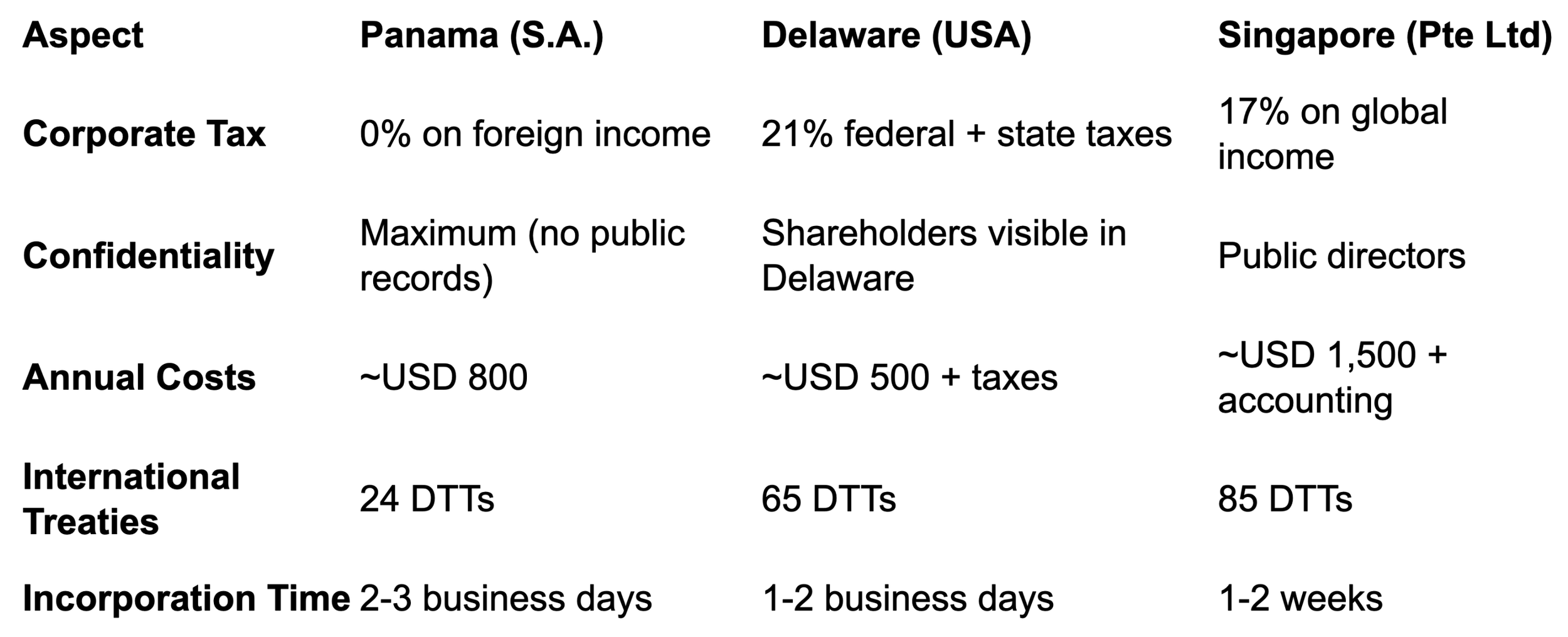

3. Comparison with Other Jurisdictions: Why Panama?

Comparative Conclusion:

Panama excels for businesses prioritizing privacy, low costs, and tax exemptions, while Singapore or the U.S. suit global operations requiring broader DTT networks.

4. Advanced Strategies to Maximize Benefits

A. Multi-Tiered Structures

Panamanian Holding Company:

Control subsidiaries in Latin America, Asia, or Europe, centralizing tax-free dividends.

Example: A Panamanian S.A. owning Mexican and Brazilian subsidiaries receives dividends with no withholding (via DTTs) and no taxation in Panama.

Trusts:

Transfer S.A. shares to a Panamanian trust to shield assets from litigation or for estate planning.

B. Intellectual Property Optimization

Cross-Border Licensing:

A Panamanian S.A. can own trademarks or patents, licensing them to operational subsidiaries abroad. Royalties received are tax-exempt in Panama.

C. Global Compliance (AML/CFT)

Ultimate Beneficial Owner (UBO) Reporting:

Since 2021, S.A.s must annually report UBO details (name, ID, address) to the Superintendency of Societies (SSA). This information is confidential and non-public.

5. Risks and Mitigation

International Gray Lists:

Panama has been flagged by groups like FATF for opacity. However, post-2023 reforms ensure full compliance with global standards.

Solution: Avoid high-risk activities (e.g., unlicensed crypto operations) and maintain auditable transactions.

Legislative Changes:

Law 254 (economic substance) mandates physical presence. Mitigate by hiring local back office services (e.g., virtual offices, administrative support).